Contents

- 1 Introduction to AI in credit score scoring and mortgage approvals

- 2 Information assortment and preprocessing

- 3 Characteristic choice and engineering

- 4 Mannequin growth and analysis

- 5 Interpretability and transparency: How Can AI Be Used To Enhance Credit score Scoring And Mortgage Approvals?

- 6 Moral concerns in AI-driven credit score scoring

Introduction to AI in credit score scoring and mortgage approvals

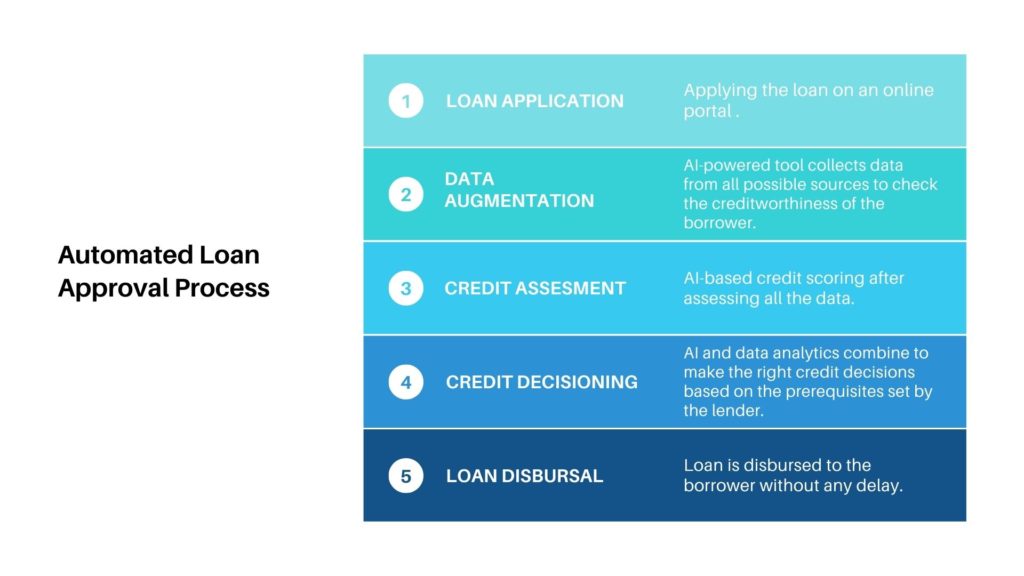

How can AI be used to enhance credit score scoring and mortgage approvals? – Synthetic Intelligence (AI) performs a vital function in revolutionizing credit score scoring and mortgage approval processes within the monetary trade. By leveraging AI algorithms and machine studying methods, monetary establishments could make extra correct and environment friendly credit score choices.

Advantages of AI within the Monetary Business

- Improved Accuracy: AI can analyze huge quantities of knowledge to evaluate creditworthiness extra precisely than conventional strategies, decreasing the chance of default.

- Effectivity: AI streamlines the mortgage approval course of by automating duties reminiscent of doc verification and threat evaluation, saving time and sources.

- Personalization: AI permits lenders to customise mortgage provides based mostly on particular person borrower profiles, rising buyer satisfaction and retention.

- Danger Administration: AI fashions can repeatedly monitor borrower conduct and market tendencies to determine potential dangers and mitigate them proactively.

Information assortment and preprocessing

Information assortment and preprocessing are essential steps in credit score scoring fashions to make sure accuracy and reliability in mortgage approvals.

Forms of knowledge utilized in credit score scoring fashions

- Credit score historical past: This contains fee historical past, excellent debt, size of credit score historical past, and kinds of credit score used.

- Demographic data: Components reminiscent of age, earnings, employment standing, and marital standing are thought of.

- Mortgage utility knowledge: Info offered by the applicant, reminiscent of mortgage quantity, function, and compensation time period.

- Public information: Any bankruptcies, foreclosures, or courtroom judgments can influence the credit score rating.

Means of gathering and cleansing knowledge for AI algorithms, How can AI be used to enhance credit score scoring and mortgage approvals?

- Information assortment: Information is gathered from varied sources reminiscent of credit score bureaus, monetary establishments, and public information.

- Information cleansing: This includes eradicating duplicates, dealing with lacking values, and standardizing codecs for consistency.

- Characteristic engineering: Creating new options or reworking current ones to enhance mannequin efficiency.

- Normalization: Scaling the info to a normal vary to stop bias in the direction of sure options.

AI dealing with giant volumes of various knowledge sources

AI algorithms excel at processing huge quantities of knowledge from completely different sources to make correct predictions.

Machine studying methods like deep studying can routinely be taught patterns and relationships in knowledge, enabling higher decision-making in credit score scoring and mortgage approvals.

Characteristic choice and engineering

Characteristic choice performs a vital function in credit score scoring because it helps determine probably the most related components that influence a person’s creditworthiness. By choosing the proper options, lenders could make extra correct choices when approving or denying loans.

AI algorithms have the aptitude to routinely determine related options by analyzing giant datasets and detecting patterns that will not be apparent to human specialists. This helps in bettering the accuracy and effectivity of credit score scoring fashions.

Comparability between conventional characteristic engineering and AI-driven approaches

- In conventional characteristic engineering, specialists manually choose and engineer options based mostly on their area data and instinct. This course of might be time-consuming and will overlook essential relationships between variables.

- However, AI-driven approaches leverage machine studying algorithms to routinely choose options based mostly on their predictive energy. These algorithms can deal with giant volumes of knowledge and determine complicated patterns that conventional strategies could miss.

- AI-driven characteristic choice can result in extra correct credit score scoring fashions and enhance the general decision-making course of in mortgage approvals.

Mannequin growth and analysis

Creating AI fashions for credit score scoring includes a number of key steps to make sure accuracy and equity in mortgage approvals. Frequent machine studying algorithms are utilized in credit score evaluation, and these fashions are rigorously evaluated to satisfy the required requirements.

Steps in growing AI fashions for credit score scoring

- Information break up into coaching and testing units

- Mannequin choice based mostly on the issue at hand

- Coaching the mannequin on the coaching set

- Evaluating the mannequin on the testing set

- Optimizing the mannequin for higher efficiency

Frequent machine studying algorithms utilized in credit score evaluation

- Logistic Regression

- Random Forest

- Gradient Boosting Machines

- Neural Networks

How AI fashions are evaluated for accuracy and equity

- Accuracy: Fashions are assessed based mostly on metrics like accuracy, precision, recall, and F1 rating to make sure they’re making right predictions.

- Equity: Varied equity metrics are utilized to judge if the mannequin is unbiased in the direction of particular teams or demographics, guaranteeing equal remedy in mortgage approvals.

- Mannequin explainability: Methods like SHAP values, LIME, and have significance assist in understanding how the mannequin makes choices, guaranteeing transparency within the credit score scoring course of.

Interpretability and transparency: How Can AI Be Used To Enhance Credit score Scoring And Mortgage Approvals?

Within the realm of credit score scoring and mortgage approvals, using AI brings in regards to the problem of guaranteeing interpretability and transparency within the decision-making course of. It’s essential for monetary establishments to grasp how AI fashions arrive at credit score choices to keep up accountability and equity.

Challenges of constructing AI fashions interpretable

- Complexity of AI algorithms: AI fashions, reminiscent of deep studying neural networks, might be extremely complicated and troublesome to interpret because of their intricate layers and connections.

- Black-box nature: Some AI fashions function as black packing containers, that means the decision-making course of just isn’t simply explainable or clear to people.

- Regulatory necessities: Laws reminiscent of GDPR and Honest Credit score Reporting Act require monetary establishments to offer explanations for credit score choices, posing a problem when utilizing opaque AI fashions.

Methods to make sure transparency and accountability

- Characteristic significance evaluation: Conducting characteristic significance evaluation will help determine the important thing components influencing credit score choices and supply insights into the AI mannequin’s decision-making course of.

- Mannequin documentation: Documenting the AI mannequin’s structure, parameters, and coaching knowledge can improve transparency and allow stakeholders to grasp how credit score choices are made.

- Interpretable AI fashions: Using interpretable AI fashions, reminiscent of resolution timber or linear regression, can provide extra transparency in credit score scoring and mortgage approval processes.

Significance of understanding how AI arrives at credit score choices

- Shopper belief: Transparency in AI algorithms builds client belief by offering clear explanations for credit score choices, fostering confidence within the lending course of.

- Equity and bias mitigation: Understanding how AI arrives at credit score choices permits for the detection and mitigation of bias, guaranteeing equity in lending practices.

- Compliance with laws: Transparency in AI fashions helps monetary establishments adjust to regulatory necessities by offering explanations for credit score choices to regulators and customers.

Moral concerns in AI-driven credit score scoring

AI-driven credit score scoring has the potential to revolutionize the lending trade by streamlining processes and rising effectivity. Nonetheless, it additionally raises essential moral concerns that should be addressed to make sure truthful and unbiased outcomes for all people searching for loans.

Figuring out potential biases that will come up in AI-powered credit score assessments is essential to understanding the dangers related to utilizing these algorithms. Some widespread biases embrace racial or gender discrimination, socioeconomic standing, and geographic location. These biases can result in unfair remedy of sure teams and perpetuate current inequalities within the lending system.

To mitigate bias and promote equity in AI algorithms, it’s important to recurrently audit and take a look at the fashions for any indicators of discrimination. Using various groups of knowledge scientists and specialists also can assist in figuring out and addressing biases which may be missed by a homogenous group. Moreover, transparency within the algorithm’s decision-making course of can enhance accountability and permit for exterior scrutiny.

Examples of moral dilemmas in utilizing AI for mortgage approvals embrace the potential for automated programs to unfairly deny credit score to people based mostly on components past their management, reminiscent of zip code or schooling degree. These choices can have far-reaching penalties on individuals’s lives and perpetuate cycles of poverty and inequality.

Mitigating Bias in AI Algorithms

- Commonly audit and take a look at fashions for indicators of discrimination.

- Make use of various groups of specialists to determine and deal with biases.

- Guarantee transparency within the decision-making means of algorithms.

Examples of Moral Dilemmas

- Automated programs denying credit score based mostly on zip code or schooling degree.

- Unintentional reinforcement of current inequalities within the lending system.

- Influence on people’ monetary alternatives and well-being.