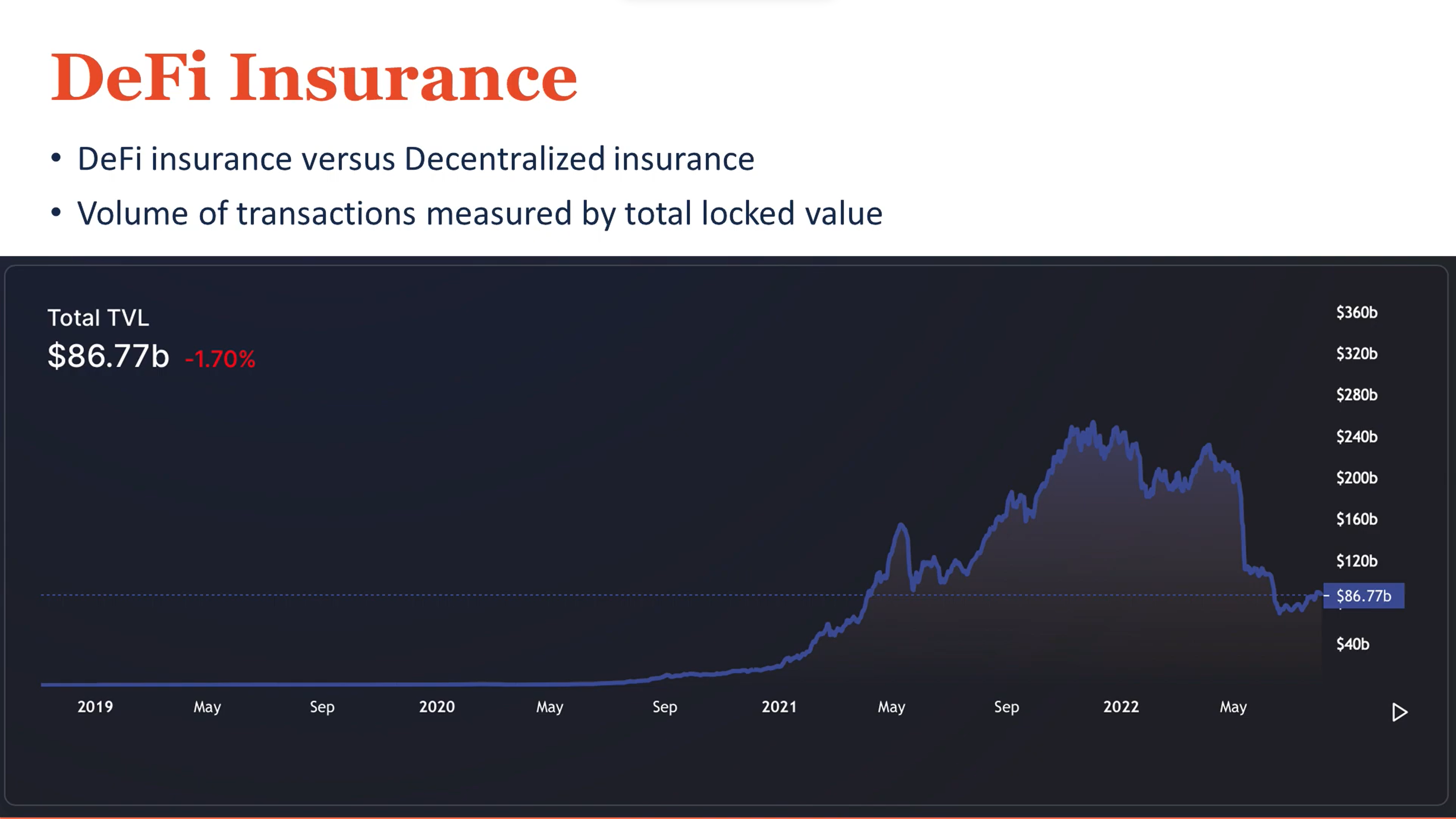

Evaluate totally different DeFi insurance coverage choices for sensible contract dangers. – The decentralized finance (DeFi) world is booming, providing thrilling alternatives for traders and customers alike. However with this innovation comes inherent dangers, notably regarding sensible contract vulnerabilities. A single bug or exploit can wipe out tens of millions of {dollars} in a matter of seconds. That is the place DeFi insurance coverage steps in, appearing as an important security internet for the burgeoning DeFi ecosystem. This text will discover numerous DeFi insurance coverage choices out there to guard your investments from sensible contract dangers, serving to you navigate this dynamic panorama with confidence.

Contents

- 1 Understanding DeFi Good Contract Dangers and Insurance coverage

- 2 5 Key DeFi Insurance coverage Methods for Good Contract Dangers

- 2.1 1. Protocol-Degree Insurance coverage: Constructed-in Safety

- 2.2 2. Decentralized Insurance coverage Platforms: Peer-to-Peer Protection

- 2.3 3. Conventional Insurance coverage Suppliers: Bridging the Hole

- 2.4 4. Self-Insurance coverage: Diversification and Threat Administration

- 2.5 5. Group-Based mostly Insurance coverage Swimming pools: Collective Safety, Evaluate totally different DeFi insurance coverage choices for sensible contract dangers.

- 3 Conclusion: Selecting the Proper DeFi Insurance coverage for You: Evaluate Totally different DeFi Insurance coverage Choices For Good Contract Dangers.

Understanding DeFi Good Contract Dangers and Insurance coverage

Good contracts, the spine of many DeFi functions, are self-executing contracts with the phrases of the settlement instantly written into code. Whereas providing automation and transparency, they aren’t proof against errors. Bugs within the code, vulnerabilities exploited by hackers, and even unexpected market fluctuations can result in vital monetary losses for customers. DeFi insurance coverage goals to mitigate these dangers by offering protection in opposition to losses stemming from sensible contract failures.

Totally different insurance coverage suppliers provide numerous protection choices, every with its personal phrases and circumstances. Understanding these variations is essential to choosing the proper safety on your particular wants. Let’s delve into a number of the outstanding DeFi insurance coverage methods out there in the present day.

5 Key DeFi Insurance coverage Methods for Good Contract Dangers

1. Protocol-Degree Insurance coverage: Constructed-in Safety

Some DeFi protocols combine insurance coverage instantly into their techniques. This usually includes setting apart a portion of protocol funds as a reserve to cowl potential losses. This strategy affords a streamlined and doubtlessly cheaper resolution because the insurance coverage is constructed into the protocol’s performance. Nonetheless, the protection quantity is likely to be restricted, and the protocol’s solvency is instantly tied to the success of the insurance coverage scheme.

Actual-life Instance: MakerDAO, a outstanding DeFi lending platform, makes use of its DAI stablecoin reserves to partially cowl losses incurred attributable to sensible contract vulnerabilities in its system.

Actionable Steps: Analysis DeFi protocols that explicitly provide built-in insurance coverage mechanisms. Verify the main points of their protection, together with the quantity, limitations, and the way the reserves are managed. Solely use protocols with clear and well-audited safety measures.

2. Decentralized Insurance coverage Platforms: Peer-to-Peer Protection

Decentralized insurance coverage platforms function on blockchain know-how, permitting customers to pool funds and share the chance. These platforms usually make the most of sensible contracts to automate the claims course of and guarantee transparency. They usually provide extra versatile protection choices in comparison with protocol-level insurance coverage, catering to a wider vary of sensible contracts and dangers.

Actual-life Instance: Nexus Mutual is a outstanding decentralized insurance coverage platform providing protection for numerous DeFi protocols and sensible contracts. Customers should purchase insurance policies and take part within the danger pool, incomes rewards for contributing to the system’s stability.

Actionable Steps: Analysis totally different decentralized insurance coverage platforms, evaluating their protection choices, premium prices, and popularity. Verify for audits and safety evaluations to make sure the platform’s robustness and trustworthiness. Rigorously learn the phrases and circumstances of any coverage earlier than buying.

3. Conventional Insurance coverage Suppliers: Bridging the Hole

Some conventional insurance coverage corporations are beginning to provide protection for DeFi dangers, leveraging their experience and established infrastructure. This strategy may present a extra acquainted and controlled atmosphere for some customers. Nonetheless, conventional insurance coverage usually comes with greater premiums and fewer flexibility in comparison with decentralized choices.

Actual-life Instance: A number of insurance coverage giants are exploring partnerships with DeFi protocols or growing specialised insurance coverage merchandise for sensible contract dangers. It is a comparatively new space, and the choices are always evolving.

Actionable Steps: Discover the insurance coverage choices of established corporations venturing into the DeFi area. Evaluate their insurance policies, premiums, and claims processes with decentralized alternate options. Think about elements akin to regulatory compliance and the corporate’s popularity.

4. Self-Insurance coverage: Diversification and Threat Administration

Self-insurance includes spreading your investments throughout a number of DeFi protocols and techniques to scale back your reliance on any single platform. This strategy would not present direct insurance coverage protection, but it surely considerably minimizes the affect of a single sensible contract failure. It requires a deeper understanding of the DeFi ecosystem and a extra proactive strategy to danger administration.

Actual-life Instance: As an alternative of investing all of your funds in a single lending protocol, diversify throughout a number of platforms with totally different danger profiles and safety measures. This reduces your general publicity to potential sensible contract vulnerabilities.

Actionable Steps: Develop a diversified funding technique that features a number of DeFi protocols. Usually monitor the safety audits and updates of the protocols you are utilizing. Keep knowledgeable concerning the newest safety threats and vulnerabilities within the DeFi area.

Understanding the dangers inherent in DeFi is essential earlier than investing, prompting a radical comparability of various DeFi insurance coverage choices for sensible contract dangers. A key facet to think about is the soundness of the platforms you employ; for instance, understanding the perfect platforms for stablecoin arbitrage might help mitigate some dangers. For extra info on figuring out appropriate platforms, you may discover this text useful: Best DeFi platforms for stablecoin arbitrage in 2025?

. Finally, a complete danger evaluation, together with the selection of platforms, is significant when deciding on DeFi insurance coverage.

5. Group-Based mostly Insurance coverage Swimming pools: Collective Safety, Evaluate totally different DeFi insurance coverage choices for sensible contract dangers.

Some DeFi communities are forming their very own insurance coverage swimming pools to collectively defend their members from sensible contract dangers. These swimming pools usually depend on group governance and shared duty. This strategy may be extremely efficient in fostering belief and resilience inside a particular DeFi group, but it surely may lack the scalability and formal construction of different insurance coverage fashions.

Actual-life Instance: A group centered on a particular DeFi protocol may create a devoted insurance coverage pool funded by its members to cowl potential losses associated to that protocol’s sensible contracts.

Actionable Steps: Interact with DeFi communities and discover whether or not they provide any community-based insurance coverage choices. Take part in group discussions to grasp the dangers and the insurance coverage mechanisms in place. Contribute to the pool should you consider it is a viable choice on your particular wants.

Conclusion: Selecting the Proper DeFi Insurance coverage for You: Evaluate Totally different DeFi Insurance coverage Choices For Good Contract Dangers.

The DeFi panorama is dynamic, and the selection of sensible contract insurance coverage ought to be tailor-made to your particular person danger tolerance and funding technique. This text has explored 5 key methods, every with its benefits and drawbacks. From built-in protocol insurance coverage to decentralized platforms and community-based swimming pools, there is a rising vary of choices to guard your investments. Experiment with totally different methods, diversify your portfolio, and keep knowledgeable concerning the newest developments in DeFi safety. Share your experiences and ask any questions you might need within the feedback under – let’s construct a safer and safer DeFi ecosystem collectively!